What Is CAGR…

What Is CAGR in Mutual Fund? Meaning, Formula & Return Home…

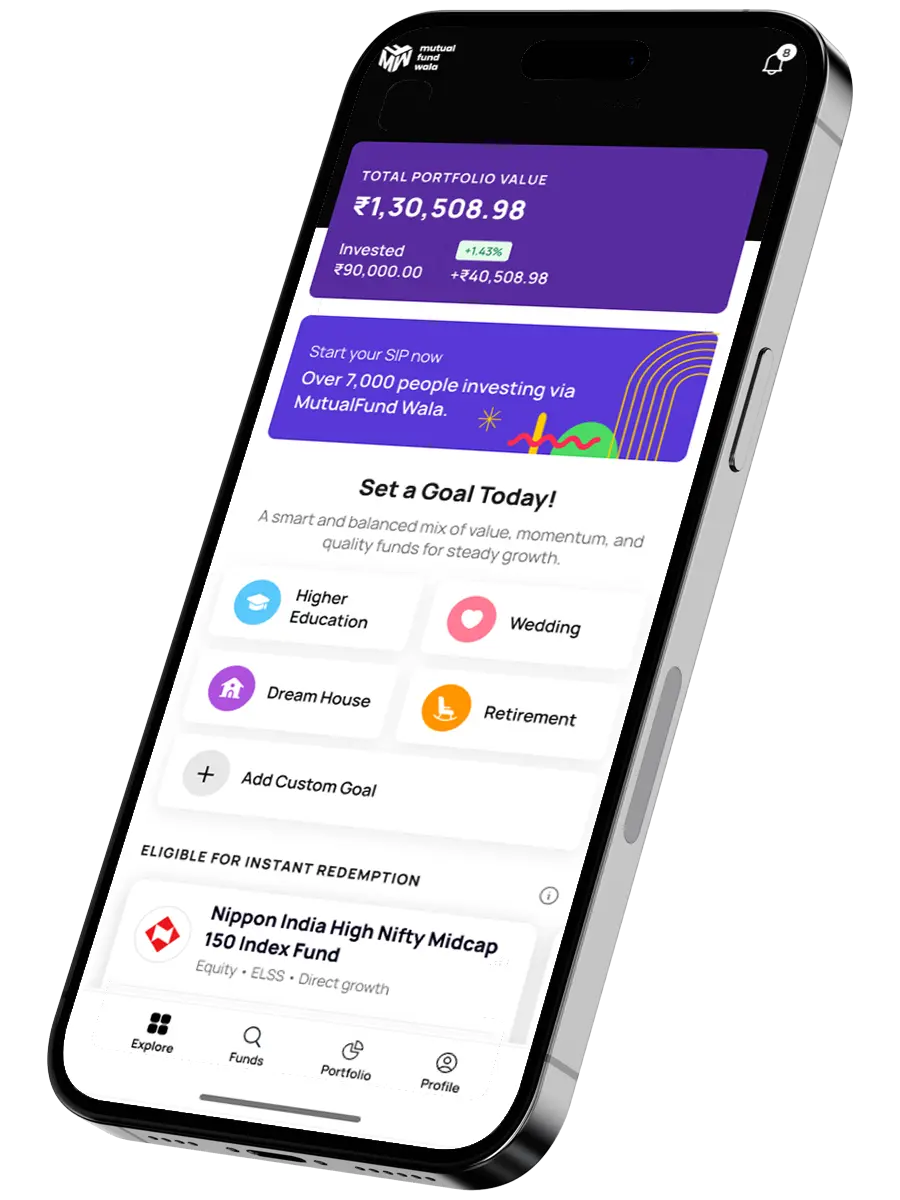

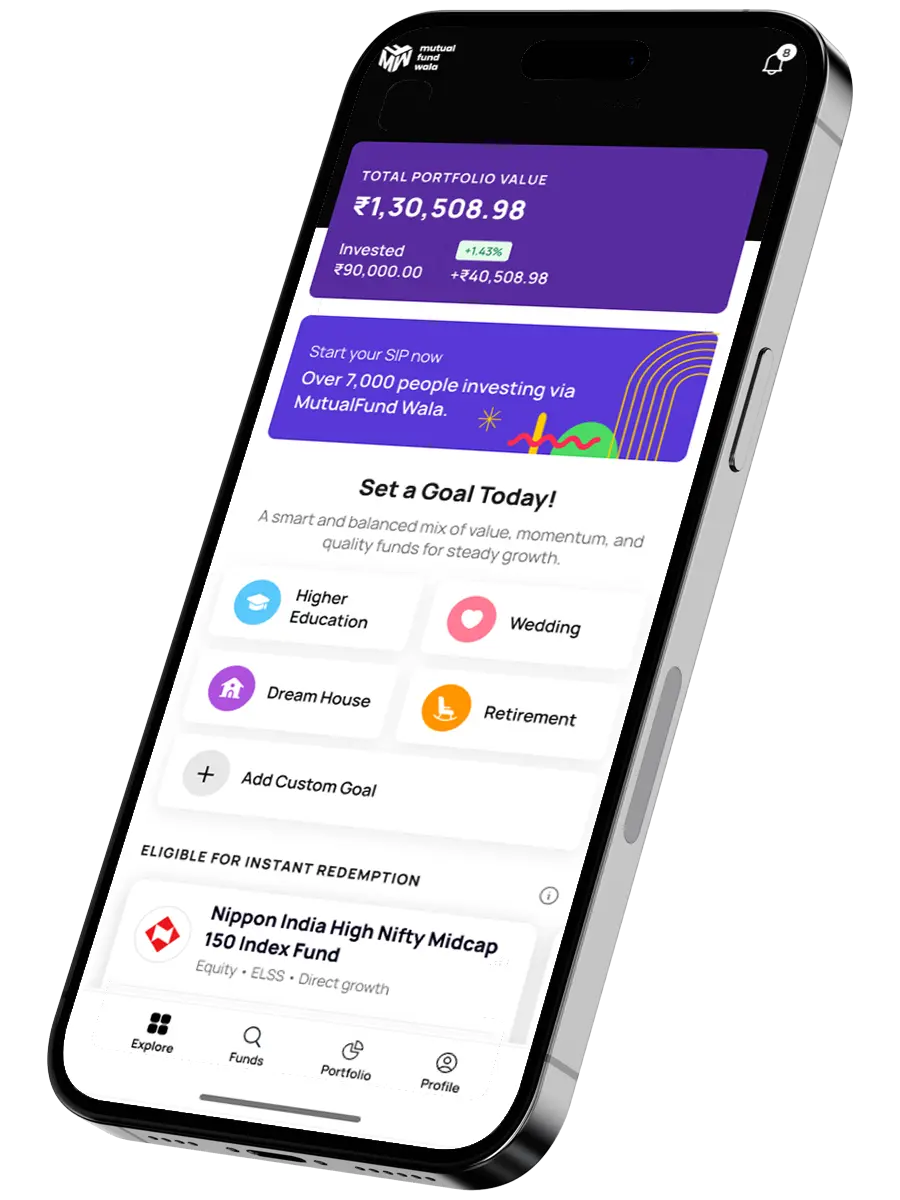

Easy account creation, KYC support, and smooth online processing.

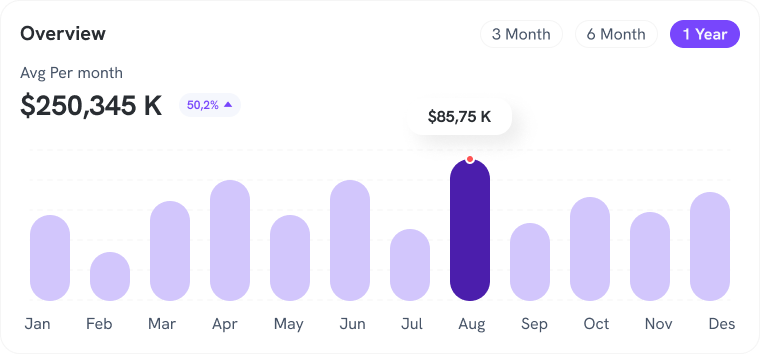

Get a consolidated view of your investments and see how your portfolio is spread across asset classes.

View your investments on the app anytime instead of managing multiple statements and emails.

Easy account creation, KYC support, and smooth online processing.

Get a consolidated view of your investments and see how your portfolio is spread across asset classes.

View your investments on the app anytime instead of managing multiple statements and emails.

We keep the investment process straightforward so you can focus on your goals, not paperwork.

If you are a first-time mutual fund investor, complete your KYC through the supported process. If your KYC is already done, we help verify it and connect your details to your investment profile.

Different goals require different types of mutual funds. On MutualFundWala, you can explore and invest in a range of categories.

#AutomatedReporting

For relatively stable returns with lower volatility compared to equity. Suitable for short to medium term goals or for investors looking for more stability.

#StableReturns

#LowVolatilityInvestment

A mix of equity and debt in one fund. Suitable for investors who want a balanced approach with controlled risk and reasonable growth potential.

#AutomatedReporting

Gold and Silver Funds invest in precious metals, helping investors protect wealth during inflation and market uncertainty without holding physical assets.

#Hedge against inflation

#Portfolio diversification

#No physical storage required

Equity Linked Savings Schemes (ELSS) offer tax benefits under Section 80C, along with the potential for long-term capital appreciation. They come with a 3-year lock-in period.

#ELSSFunds

#LongTermGrowth

#Equity-based long-term growth

Systematic Investment Plans allow you to invest a fixed amount regularly (monthly/quarterly). They help build discipline and average out market ups and downs over time.

#SIPInvestment

#SmartInvesting

#Ideal for long-term goals

#AutomatedReporting

For relatively stable returns with lower volatility compared to equity. Suitable for short to medium term goals or for investors looking for more stability.

#StableReturns

#LowVolatilityInvestment

A mix of equity and debt in one fund. Suitable for investors who want a balanced approach with controlled risk and reasonable growth potential.

#AutomatedReporting

Gold and Silver Funds invest in precious metals, helping investors protect wealth during inflation and market uncertainty without holding physical assets.

#Hedge against inflation

#Portfolio diversification

#No physical storage required

Equity Linked Savings Schemes (ELSS) offer tax benefits under Section 80C, along with the potential for long-term capital appreciation. They come with a 3-year lock-in period.

#ELSSFunds

#LongTermGrowth

#Equity-based long-term growth

Systematic Investment Plans allow you to invest a fixed amount regularly (monthly/quarterly). They help build discipline and average out market ups and downs over time.

#Ideal for long-term goals

Note: All investments are subject to market risks. Past performance does not guarantee future returns.

Use our free calculators to understand how your investments can grow over time. These tools are for guidance and planning and should be used along with proper advice.

Plan your investments smartly without disturbing your monthly expenses.

Estimate how a one-time investment can grow over time using the power of compounding. This calculator helps you project the future value of your lump-sum investment based on the expected rate of return and investment duration.

Plan your financial goals with confidence. Calculate how much you need to invest regularly to achieve your goals.

Estimate how much wealth you need to build for a comfortable retirement in the future. This calculator helps you project the required retirement corpus based on your investment timeline and expected rate of return.

A wedding is an emotional milestone and a big financial event. The Marriage Planner helps you estimate how much you need to save or invest so you can fund the celebration without stress or last-minute loans.

Calculate regular withdrawals from your investment and understand how long your corpus can last with expected returns.

Founder

MutualFundWala is led by a team that believes in simple, honest and long-term investing.

Our founder Mr. ShashiKant Bahl and core team members have been associated with the financial services and mutual fund industry for several years. Over time, we have helped a wide range of investors – salaried professionals, business owners, self-employed individuals, and retirees – plan and manage their mutual fund investments.

Behind our digital platform is a support team that takes your queries seriously, follows up on requests, and ensures that you receive timely support for documentation, KYC, and portfolio-related questions.

Here are answers to some common questions investors ask before starting their mutual fund journey with us.

We help you invest in mutual funds in a simple and organised way. You get digital convenience along with human guidance. We support you with KYC, fund selection based on your goals, and portfolio tracking in one place.

Your investments are made directly in mutual fund schemes of registered AMCs. Units are held in your name, and you receive confirmations and statements from the respective AMCs or registrars. We do not hold your money; we facilitate investments as a mutual fund distributor under applicable regulations.

No. Mutual fund investments are subject to market risks. Returns are not guaranteed and can fluctuate based on market conditions and the type of fund chosen. We help you understand risks and choose funds aligned with your goals and risk profile.

We distribute regular plans of mutual funds. Our income generally comes from distributor commissions paid by the AMCs. You do not pay any separate advisory fee to us. The total expense ratio (TER) of the scheme, as decided by the AMC, is built into the fund itself.

Many mutual funds allow you to start a SIP with a low minimum amount (for example ₹500 or ₹1,000 per month, depending on the scheme). Lump-sum minimums also vary by scheme. We can help you choose options that fit your budget.

Yes, you can stop, pause (where allowed), or modify your SIP as per the rules of the respective AMC. Our team and platform assist you in placing such requests.

The ideal duration depends on your goal and the type of fund. Equity mutual funds usually require a longer horizon to handle market ups and downs, while some debt funds may be used for shorter horizons. We generally recommend aligning investments with clear timeframes and sticking to them.

You can reach us through the app, our website contact form, email, or by calling our support number. Our team will assist you with queries on investments, transactions, and portfolio reviews.

© 2026 MutualFundWala | AMFI Registered Mutual Fund Distributor | ARN-275889, Valid by 06-09-2026 | All rights reserved